auto auto liability cheap

auto auto liability cheap

Insurance policy Surcharges Many insurance policy companies have an additional charge schedule. Unless the insurance firm concurs to waive those costs when a crash is not your mistake, you may see a boost in your costs. Luckily, this is rarely the instance: In truth, insurance companies seldom penalize you for a crash that was not your mistake.

An insurance agent you depend on can help with this. If you have a house, cars and truck, and also boat that require to be guaranteed, take into consideration taking advantage of one of the many package strategies offered from the majority of major insurance policy carriers.

This evidence will make a significant distinction in your case (cheapest car). Take your time giving your version of the accident to the police policeman to make certain you offer a correct recounting.

Take a 2nd to relax. Outline the events of the collision with the most information possible. It's okay if you can not bear in mind whatever. Do your ideal to offer the cops the most accurate and in-depth account you can. Get clinical interest asap if required.

Facts About Adding A Teen To Your Auto Insurance Policy - Incharge Debt ... Uncovered

Have your auto crash lawyer contact the at-fault motorist's insurance coverage company to submit a claim. Never ever tell the at-fault chauffeur's insurance coverage company anything about the crash, given that you might pursue this insurance coverage company to pay your case.

Practically all injury lawyers offer a cost-free consultation that has no obligations or risks (car insurance). It's simply an opportunity to discuss your crash to a professional. And also to obtain their viewpoint regarding your choices for legal remedy. The insurance provider will have a team of attorneys working for them. And also so should you.

They are not. That is what your attorney is for - perks. Enter Call with the Attorneys at Abels & Annes Today Never allow problems regarding possible costs raises deter you from seeking a case - cheaper car insurance. A lawyer can aid guarantee you recoup full settlement for any problems endured in an accident.

Constantly seek the advise of a trusted lawyer following an automobile crash. At Abels & Annes, P.C., we routinely stand for people like you who have been injured in mishaps.

The 9-Minute Rule for How Much Does Insurance Go Up After An Accident?

If you're in a crash, and it is your fault, your insurance price will certainly increase. vehicle. But also if the accident was not your fault, your insurance coverage rate may still enhance. Your insurance costs can raise, depending on the situation of an accident, your history of making insurance claims, as well as the sort of insurance policy protection you have.

In most states, the at-fault driver's insurance will be expected to cover the cost, yet your rates might still climb. If you submit a not-at-fault insurance claim, as well as your insurance policy service provider raises your price, it could be time to search for a new insurance policy company. Theoretical Instance Intend you're driving residence from work one day, paying very close attention to the roadway ahead, and the drivers around you when suddenly an additional chauffeur runs a quit indicator as well as rams into the side of your car.

states, not-at-fault insurance claims are submitted against the at-fault car owner's insurance policy. If you are able to file versus the at-fault celebration, you follow this link are less likely to see a boost in your insurance policy bill (cheap). Even if you do require to file versus your own policy, some insurance policy providers still will certainly not raise your price for a not-at-fault claim.

This is just one of them. What You Can Do Concerning It If you file a not-at-fault case, as well as your insurance policy provider increases your price, it would probably remain in your ideal rate of interest to begin going shopping for a brand-new provider. insurance. New fees are used on your insurance revival date, so you must have some time in between filing as well as really paying for the surcharge.

The Buzz on Why Did My Auto Insurance Rates Change?

risks vehicle liability cheaper car

risks vehicle liability cheaper car

insured car car laws vehicle insurance

insured car car laws vehicle insurance

The reverse can apply for much less secure rides. Some insurance companies enhance costs for autos more susceptible to damage, resident injury or burglary and they lower prices for those that get on much better than the norm on those steps.

Before you head down to the car dealership, do some research study on the auto you desire to purchase. Does the lorry that has captured your eye have solid safety rankings? Is this details design often stolen? Knowing the response to a couple of basic questions can go a long method towards maintaining your prices low.

, metropolitan chauffeurs pay more for cars and truck insurance policy than those in small towns or rural locations.

If you have actually been accident-free for a long duration of time, don't obtain obsequious. Stay careful and also maintain your excellent driving routines. If you are guaranteed and also accident-free for 3 years, you likely receive a State Ranch accident-free savings. As well as despite the fact that you can't rewrite your driving background, having a crash on your document can be a vital tip to constantly drive with care and treatment.

The Best Strategy To Use For Does Insurance Cover A Crashed Car And Will My Rates Go ...

, particularly single men.

If you're a pupil, you could be in line for a discount rate. A lot of vehicle insurance firms give discounts to pupil vehicle drivers who maintain great grades. What are ways to aid reduced car insurance policy premiums? Going down unneeded coverage, increasing your deductible or minimizing insurance coverage limitations might help lower insurance prices. Your insurance policy representative can share the pros and cons of these alternatives.

In general, it doesn't hurt and might very well aid - credit score. These use based vehicle insurance programs record just how you drive and the miles you drive., in some cases called packing, can save you cash.

The 20-Second Trick For Will My Car Insurance Go Up After An Accident? - Anidjar ...

This product is planned for basic info just. It does not broaden protection past the policy agreement (insurance). Please refer to your policy agreement for any kind of certain info or questions on applicability of protection.

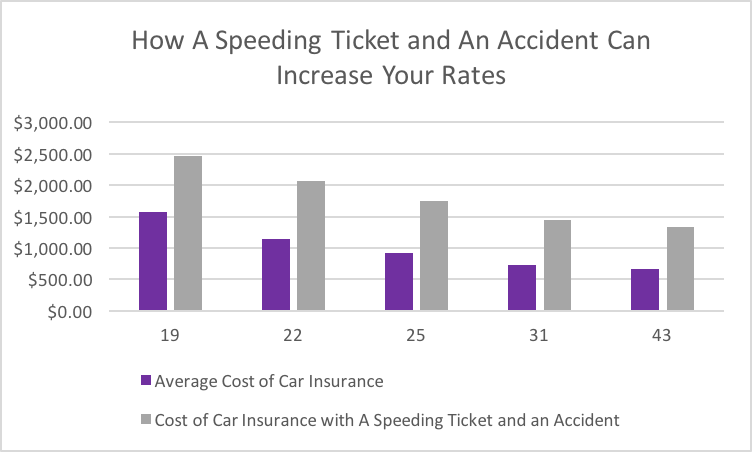

An auto accident is never a good idea, and that's partly due to the fact that of your car insurance: rates frequently raise after a crash, even if you really did not create it. How much does insurance policy rise after an accident? The solution to that concern depends upon your insurance firm, the state you're in, the amount of damages and other aspects.

cheap car laws cheaper business insurance

cheap car laws cheaper business insurance

Rates are impacted complying with an accident for a factor: insurance coverage carriers desire to make cash. Insurers reason that due to the fact that you've had an accident, you're not as secure of a vehicle driver and extra most likely to have crashes in the future so your rates require to be higher to counter that.

Because every state has its very own motor lorry regulations and also laws, price increases aren't regular (cheapest car). And also rates also differ depending on the seriousness of the mishap.

The 30-Second Trick For How Much Does Car Insurance Go Up After An Accident?

This consists of physical injury liability and also building obligation, as well as in some states also consists of uninsured driver protection and also individual injury protection. Each state establishes its very own minimum amounts of protection. Even without detailed and collision insurance coverage, your prices will certainly boost from an at-fault accident. automobile. This is since you, as a vehicle driver, are still a danger.

Even with a larger premium increase on the whole, you'll still pay a lot less yearly than you would certainly for complete protection complying with an accident. Average yearly premium with tidy driving history Typical yearly costs with one at-fault accident, States with the lowest costs increase after a mishap usually have legislations that favor the motorist over the insurance company.

If you have a $200 or $500 insurance deductible, elevating it to $1,000 or more can lead to substantial financial savings. Just do so if you understand you would certainly be able to pay the greater deductible in the event of a future case. If you have full insurance coverage, take into consideration going down crash as well as comprehensive.

An additional insurer might provide less weight to your current mishap than your current one. If you want to remain with your existing insurance provider, a fast call to your agent may reveal additional discount rates that can shave off some costs.

Automobile Insurance Guide - Questions

In the long term, job toward ending up being a safer motorist, as well as likewise towards improving your debt score. money. Both of these goals will indicate lower rates in the future.

It is often difficult to say who's at fault in a mishap, which may influence your price too. Partial obligation may need your insurance provider to subrogate, or seek payment from the other vehicle driver's insurance firm and also they might desire to pass that expense on you. If your insurer has placed you in the risky group, our referrals on minimizing premium prices noted above might serve.

Shopping around or opting for a high-risk insurance provider may provide you a lower rate - trucks. If you're wondering just how much insurance coverage prices enhance after a crash, the response is that it depends on your firm, the state you reside in and much more. risks. The national ordinary boost for motorists with full insurance coverage is 34%; it's an even greater 44% if you have minimal coverage.

cheap car cheap car cheaper cars cheaper car

cheap car cheap car cheaper cars cheaper car

The rise should go down from your account in three years. Insurance coverage makes use of Quadrant Information Provider to assess quoted rates from countless postal code in all 50 states, using the leading 15 insurance coverage service providers to establish the average auto insurance policy costs - suvs. Priced estimate prices are based upon the profile of a three decades old man and also woman with clean driving records as well as great credit report.